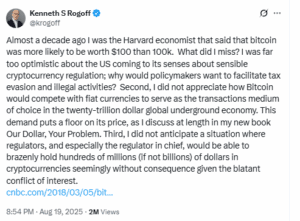

Kenneth Rogoff, a Harvard economist and former chief economist at the International Monetary Fund, has admitted his decade-old Bitcoin prediction was wrong. In 2018, Rogoff said Bitcoin was “more likely to be worth $100 than $100,000 ten years from now.” On August 19, 2025, he posted on X acknowledging that his forecast had failed.

Rogoff explained that he had been too optimistic about U.S. regulators cracking down on cryptocurrencies. Instead, pro-crypto laws such as the GENIUS Act and the CLARITY Act were passed. These gave the industry legal backing and consumer protections. He also admitted underestimating Bitcoin’s role in the $20 trillion global underground economy, which he now believes created a strong price floor.

His third error was failing to anticipate a conflict of interest in which senior policymakers would personally hold large amounts of crypto while setting regulation. He did not expect a situation where regulators “brazenly hold hundreds of millions, if not billions, of dollars in cryptocurrencies seemingly without consequence.”

Bitcoin’s Rise Proved Him Wrong

At the time of his 2018 forecast, Bitcoin traded below $10,000. Rogoff believed regulation would remove its main use cases, including tax evasion and money laundering, and that the price would collapse. Instead, Bitcoin crossed $100,000 in December 2024 and is now trading between $112,000 and $124,000.

The rally has been driven by U.S. spot Bitcoin ETFs, broader institutional demand, and policy changes under the Trump administration.

Rogoff’s concern about conflicts of interest comes at a time when President Trump is reported to hold $1.2 billion in crypto wealth. His holdings include personal wallets, stakes in World Liberty Financial, and a $TRUMP meme coin. Trump Media & Technology Group also owns more than 18,000 Bitcoin, worth about $2.1 billion. This makes it one of the largest corporate holders globally.

Several members of Trump’s cabinet and advisors also hold crypto. Industry donors have given more than $26 million to Trump-aligned political groups. Critics in Congress argue these ties blur the line between policymaking and personal profit.

Harvard Endowment and Wall Street Giants Bet Big on BTC

Harvard Management Company, which oversees the university’s $53 billion endowment, disclosed earlier this year that it held a $116 million stake in BlackRock’s iShares Bitcoin Trust.

Major financial institutions have also released year-end 2025 forecasts. Standard Chartered expects Bitcoin to reach $200,000. Citi projects a base case of $135,000 and a bullish scenario near $199,000. Bitwise CIO Matt Hougan and VanEck’s research team both see targets between $180,000 and $200,000. BlackRock has not issued a firm target, but CEO Larry Fink has suggested Bitcoin could eventually approach $700,000 if sovereign wealth funds allocate to it.

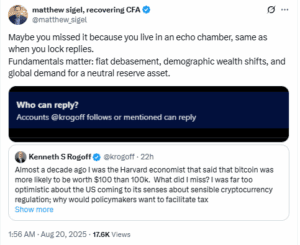

Hougan said Rogoff overlooked the strength of decentralization. VanEck’s Matthew Sigel argued that Rogoff wrote Bitcoin’s “obituary too early” from within an academic echo chamber.

Other long-time skeptics, including Warren Buffett, Jamie Dimon, Paul Krugman, and Charlie Munger, have kept their critical stance on Bitcoin. Rogoff’s reversal therefore stands out as one of the few cases where a well-known critic admitted his thesis had failed.

Despite conceding that his prediction was wrong, Rogoff has not embraced Bitcoin. His new book, Our Dollar, Your Problem, describes Bitcoin’s role in the underground economy and frames its value as a result of weak regulation rather than intrinsic strength.