The US dollar is consolidating near local highs ahead of the release of key US inflation data, which is expected to provide the Federal Reserve with its next major policy signal. Investors anticipate that the upcoming Consumer Price Index (CPI) figures could confirm easing price pressures, reinforcing expectations of a pause in the Fed’s monetary easing cycle.

The Japanese yen continues to weaken under the pressure of domestic political developments and the Bank of Japan’s dovish stance. Following Sanae Takaichi’s victory and the formation of a new coalition government, markets have revised expectations for the timing of potential rate hikes, adding further downward pressure on the yen. While political stability and expected increases in defence spending have buoyed the Japanese equity market, the currency remains near its lows as traders see little chance of policy tightening by the BoJ in the coming months.

Meanwhile, the Canadian dollar is receiving modest support from firmer oil prices and anticipation of upcoming retail sales data from Canada.

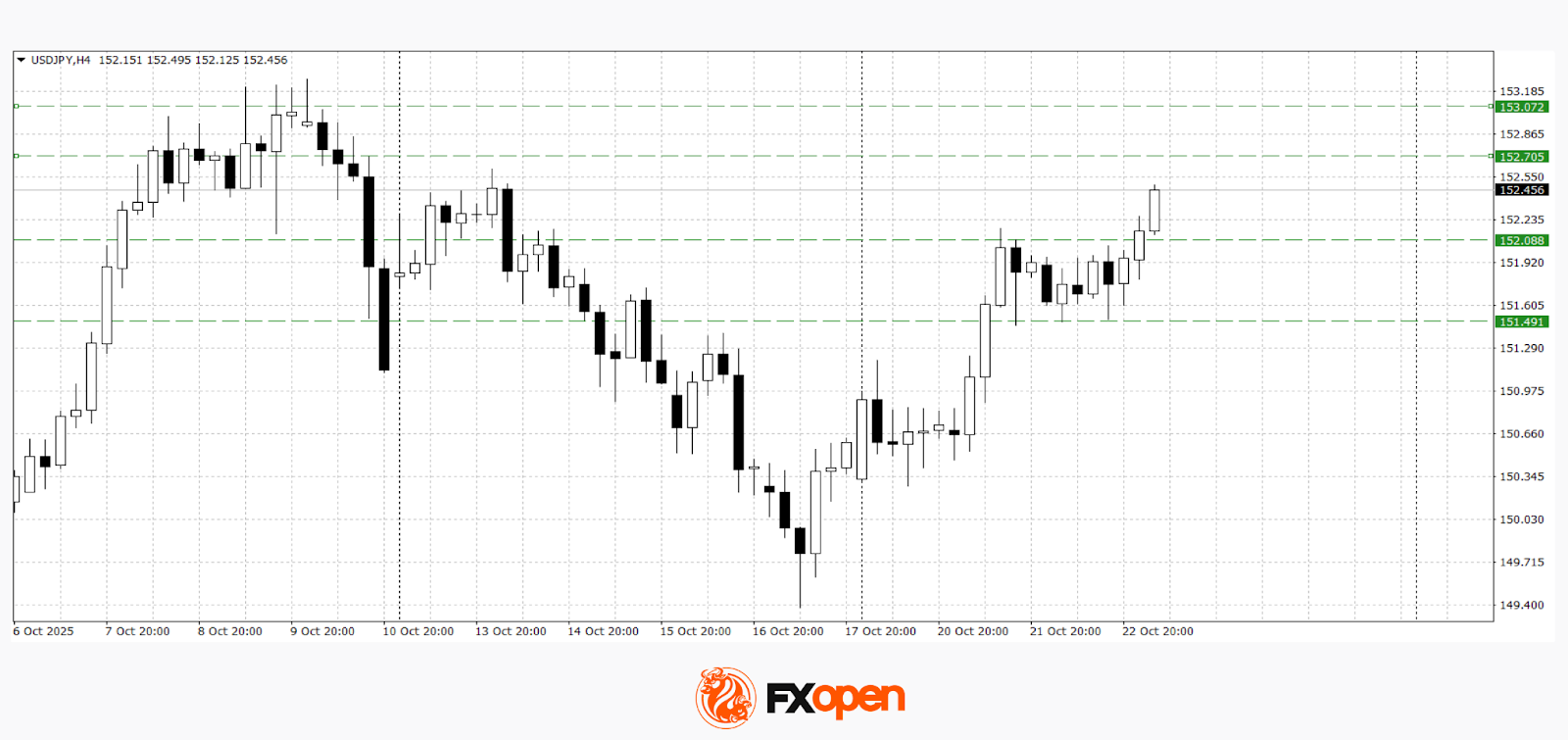

USD/JPY

The USD/JPY pair resumed its advance earlier this week as the yen remained under broad fundamental pressure. After testing 152.00, the upward momentum slowed and the pair moved into a consolidation range between 151.40–152.00. Overnight, buyers managed to push the pair above 152.00, setting the next target in the 152.70–153.20 area.

Key events likely to influence USD/JPY in the coming sessions:

- 15:30 (GMT+3): US Initial Jobless Claims;

- 17:00 (GMT+3): US Existing Home Sales;

- Tomorrow 15:30 (GMT+3): US Core CPI.

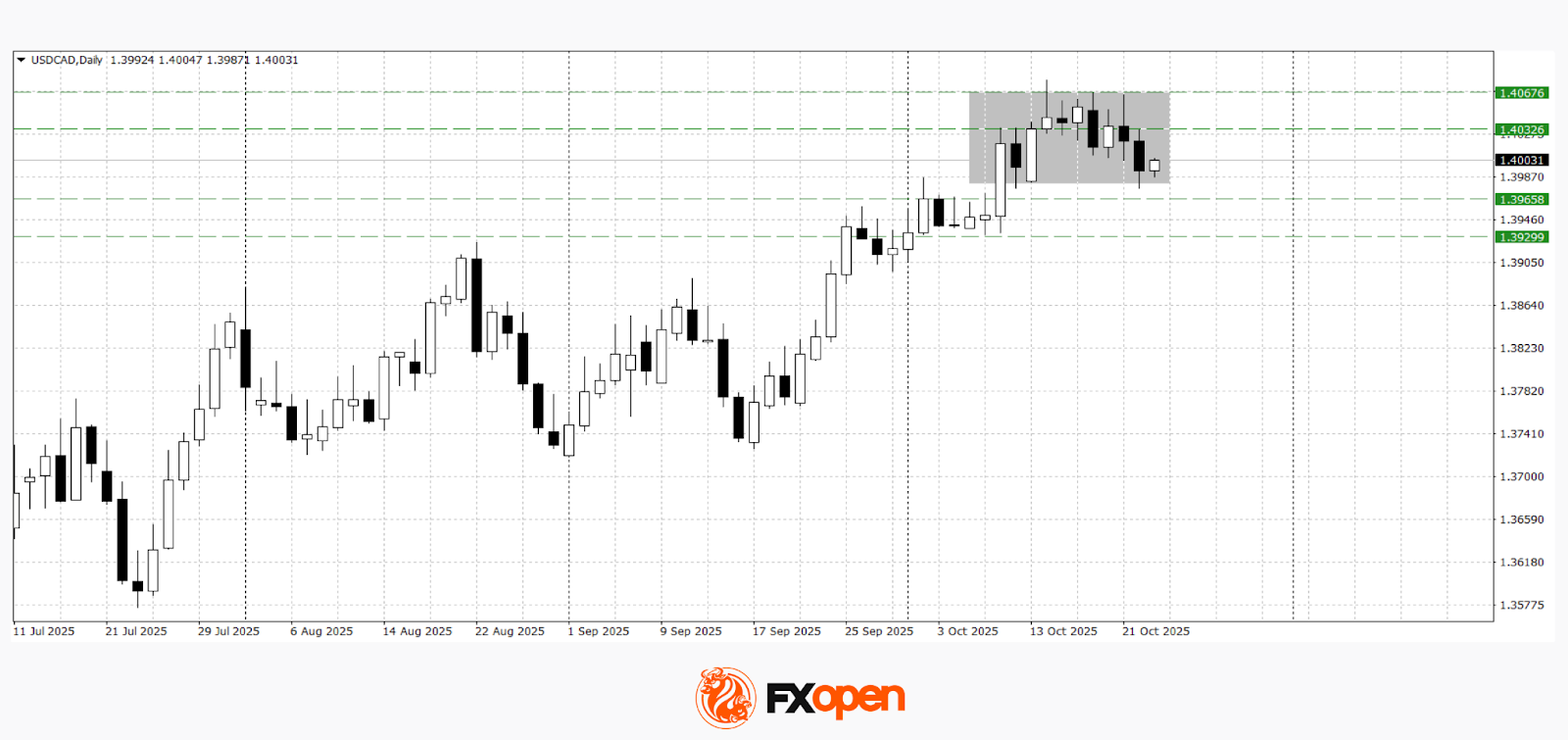

USD/CAD

The USD/CAD pair has traded within a narrow range of 1.4000–1.4080 over the past two weeks. A loss of upward momentum led to a break below key support at 1.4000, with the pair slipping to 1.3970. Technical analysis suggests a potential continuation lower towards 1.3930–1.3960, where a Tower Top reversal pattern has formed on the daily chart.

A move back above 1.4030 would be required to negate the bearish outlook.

Key events that may affect USD/CAD:

- 15:30 (GMT+3): Canada Core Retail Sales;

17:25 (GMT+3): Speech by Fed Vice-Chair for Supervision Michael S. Barr; - Tomorrow 15:30 (GMT+3): Canada New Housing Price Index.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.