The anticipated surge in stablecoin launches in the United States could devolve into a zero-sum competition, according to CoinDesk, citing a report from JPMorgan.

Analysts at the bank, led by Nikolaos Panigirtzoglou, noted that the segment has recently grown to a substantial $270 billion. However, its share of the cryptocurrency market has remained virtually unchanged since 2020, at around 8% of total capitalization.

Experts believe this trend indicates that the expected arrival of new players in the sector will merely lead to a redistribution unless the entire industry significantly expands.

The adoption of the GENIUS Act in the U.S. has already triggered a wave of new asset launches, JPMorgan noted. Back in March, FT journalists highlighted plans by some global banks and fintech companies regarding such assets, dubbing it a “stablecoin race.” Most of these projects primarily aim to compete with the U.S.-dominant USDC from Circle.

In September, the largest DEX for perpetual contracts, Hyperliquid, selected the issuer of its own USDH coin. This decentralized platform accounts for about 7.5% of the circulating USDC.

The company behind USDT, Tether, introduced USAT—a stablecoin fully compliant with the GENIUS Act.

Circle’s position is also potentially threatened by coins from fintech giants like PayPal (PYUSD), Robinhood, and Revolut, analysts suggest.

In response, the issuer of USDC is developing Arc—a blockchain specifically tailored for stablecoin operations. The solution aims to enhance transaction speed, security, and cross-chain compatibility. The company has also deepened integration with Hyperliquid.

In June, Circle went public on Nasdaq and subsequently applied for a trust bank license in the U.S.

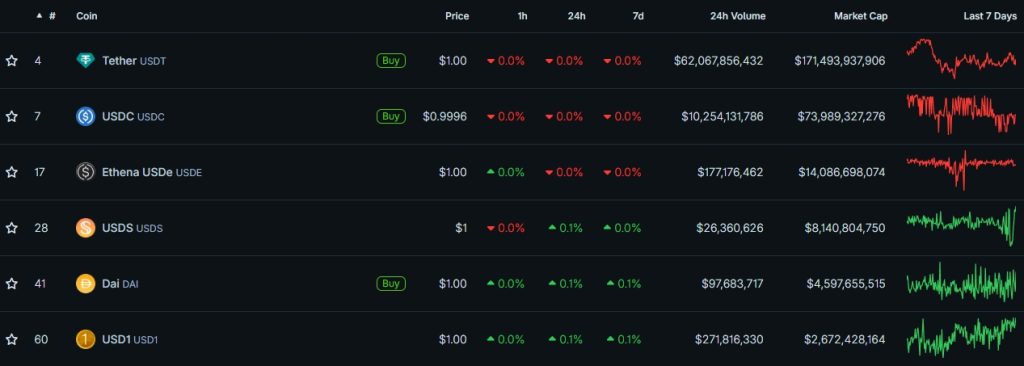

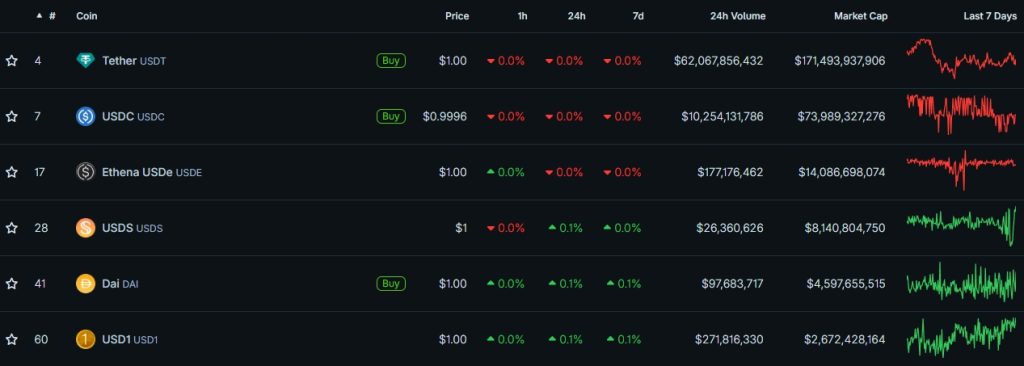

The market capitalization of the leading stablecoin segment, USDT, stands at approximately $171.5 billion, while USDC is nearly $74 billion.

USD1 from the DeFi platform World Liberty Financial, linked to the family of former U.S. President Donald Trump, has risen to sixth place with a valuation of ~$2.7 billion.

The supply of PYUSD, launched by PayPal in August 2023, does not exceed $1.4 billion.

In September, Kyle Klemmer, co-founder of Blockstreet, the company promoting USD1, predicted its dominance by the end of the current president’s second term in three years.

Earlier, Standard Chartered noted that clients show more interest in stablecoins than in Bitcoin.

Stripe co-founder and CEO Patrick Collison explained the popularity of stablecoins among businesses as being due to faster, cheaper, and more reliable payments compared to traditional systems.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!