Jupiter, a decentralized exchange (DEX) aggregator on Solana, has announced a partnership with Ethena Labs to create JupUSD, a Solana-native stablecoin. The stablecoin will launch in the Q4 of 2025, after undergoing audits and integration work. JupUSD aims to become a core liquidity engine inside Jupiter’s ecosystem—used across trading, lending, perpetuals, and more.

Jupiter to Replace USDC with Native Stablecoin

According to an announcement, JupUSD will serve as Jupiter’s primary stable asset for trading, lending, and perpetual markets. Moreover, the exchange plans to gradually convert about $750 million in USDC liquidity from its pools into JupUSD. This will also make it the platform’s default dollar unit for swaps and collateral.

Stablecoins are cryptocurrencies that maintain a 1:1 value with the U.S. dollar, typically backed by cash or Treasury assets. They form the foundation of decentralized finance (DeFi), enabling on-chain transactions without reliance on traditional banking systems.

At launch, JupUSD will be backed by USDtb, a tokenized dollar issued by Ethena Labs and supported by U.S. Treasury holdings through BlackRock’s BUIDL fund. Collateral will later expand to include Ethena’s synthetic dollar, USDe, a yield-generating asset designed to maintain dollar parity through hedged derivatives positions.

Ethena Labs will manage minting and collateral through its white-label stablecoin platform. The system lets protocols issue branded, fully backed stablecoins without building new infrastructure. The partnership marks the first Solana deployment of Ethena’s “stablecoin-as-a-service” model, following pilots on Sui and MegaETH.

USDtb is issued in partnership with Anchorage Digital Bank and complies with the GENIUS Act of 2025, a U.S. federal law enacted in July that mandates full reserve backing, third-party audits, and transparent disclosures for stablecoin issuers.

Solana’s Largest DEX Moves Toward Internal Liquidity

Jupiter currently holds around $3.6 billion in total value locked (TVL), making it Solana’s largest DeFi protocol.

Across Solana, stablecoin circulation exceeds $15.3 billion, while global stablecoin capitalization now stands above $310 billion,

Jupiter’s entry into stablecoin issuance mirrors a broader DeFi trend where platforms such as Aave (GHO) and Curve (crvUSD) launch native stablecoins to internalize liquidity and revenue.

You May Also Like: Putin Adviser Claims US Using Stablecoins and Gold to Reduce $37 Trillion Debt

Ethena’s compliance-driven structure under the GENIUS Act of 2025 — enacted in July after bipartisan approval in Congress — places JupUSD within a regulated custodial framework, with reserves primarily held in tokenized U.S. Treasuries through the BUIDL fund. The law now requires issuers to publish regular attestations and maintain 100% cash or Treasury-backed reserves.

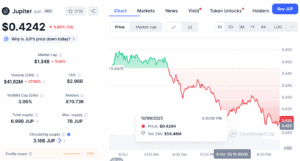

At press time, Jupiter native token JUP to USD is trading at $0.4242, down 5.68% over the past 24 hours.