In the crypto industry, the term “diamond hands” is a popular piece of slang used to describe investors who exhibit unwavering and steadfast commitment to their cryptocurrency holdings, especially during periods of market volatility. These traders resist the urge to sell, even in the face of significant price fluctuations or downturns. In contrast, those with “paper hands” are quick to sell at the first sign of trouble, often succumbing to the price drops that accompany sudden market movements. The diamond hands approach is often celebrated on social media platforms like reddit, where communities rally around the notion of hodl—holding onto investments for the long term, regardless of the high-risk nature of cryptocurrencies like bitcoin. This steadfast strategy is viewed as a way to capitalize on the long-term potential of the blockchain ecosystem, despite the inevitable price swings and market fluctuations.

The term “diamond hands” first gained traction during the meme-driven trading frenzy of 2021, where it became synonymous with the determination to endure market downturns while maintaining a strong crypto portfolio. Investors embracing this mindset often believe that their assets will appreciate over time, despite the inherent challenges posed by market volatility. They advocate for a buy-and-hold investment strategy, emphasizing the importance of staying the course even when faced with adverse price movements. This resilient approach not only distinguishes them from the paper hands crowd but also fosters a sense of community among like-minded traders who share insights and support each other through the ups and downs of the crypto market.

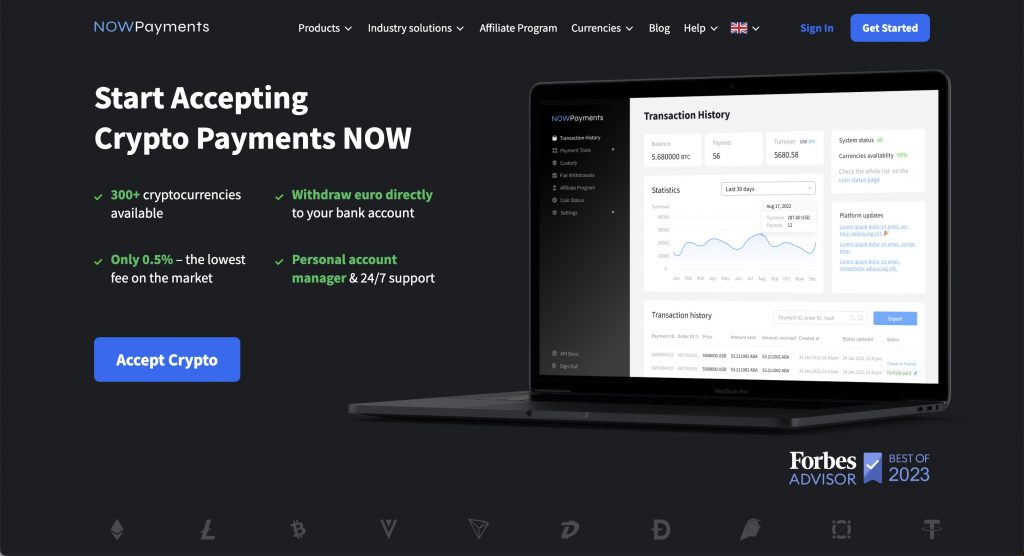

How NOWPayments Supports Diamond-Handed Investors

For those who embrace the diamond hands philosophy, having a secure and efficient way to manage crypto transactions is essential. NOWPayments provides a non-custodial payment solution that enables businesses and individuals to accept and manage cryptocurrency payments without the need for third-party intermediaries. This ensures that users have full control over their assets, staying true to the diamond hands mindset of long-term investment.

With support for over 300 cryptocurrencies, NOWPayments allows investors to accept and store their preferred assets, reinforcing their belief in the long-term potential of crypto. Additionally, its auto-conversion feature helps protect against extreme volatility by converting crypto payments into stablecoins or fiat, allowing users to mitigate some risks while maintaining their holdings. Whether you’re an individual investor or a business looking to accept crypto payments, NOWPayments offers a seamless and secure way to participate in the digital asset economy without compromising your investment strategy.

Diamond-handed investors often seek ways to further integrate crypto into their everyday lives, and NOWPayments facilitates this transition by providing crypto-friendly payment solutions that help businesses and users transact effortlessly. As the crypto market continues to evolve, having a reliable payment processor like NOWPayments ensures that those with diamond hands can hold, use, and grow their crypto investments with confidence.

What Is “Diamond Hands”?

In the crypto ecosystem, the term “diamond hands” refers to traders who are committed to holding onto their investments despite market volatility. This slang term is popular among crypto communities and signifies a strong risk tolerance against short-term market movements. Unlike those with “paper hands”, who feel the pressure to sell when faced with a wild price fluctuation, traders with diamond hands embrace the notion of hodl, prioritizing long-term gains over immediate losses.

The diamond hands definition encapsulates a mindset rooted in resilience. The term started as a meme within crypto enthusiasts, symbolizing the ability to withstand market stress without succumbing to panic. It serves as a rallying cry to decentralize one’s emotional response to the ever-changing currency landscape. No matter how much the price changes, those with diamond hands remain steadfast, reinforcing their belief in the underlying value of their investments.

The Origins of “Diamond Hands”

In the world of cryptocurrency, the term used to describe an investor with a strong belief in the long-term value of their holdings is known as diamond hands. This crypto slang emerged as a way to highlight the resilience of crypto investors who refuse to sell their assets during market fluctuations. The opposite of diamond hands is paper hands, referring to those who quickly sell off their investments at the first sign of a downturn. This term “diamond hands” symbolizes a strong conviction in holding onto assets, even when faced with big price drops.

The concept of diamond hands started gaining traction within the crypto community, becoming a popular term used to encourage individuals to stay the course rather than engage in constant buying and selling. Investors boasting diamond hands might focus on diversifying your portfolio while maintaining a steadfast approach to their core investments. Ultimately, the phrase captures the determination of those who believe that patience will yield greater rewards in the volatile world of cryptocurrencies.

Do You Have Diamond Hands?

In the world of cryptocurrency, the term “diamond hands” signifies a strong belief in the long-term potential of an asset. Individuals with diamond hands are committed to holding onto investments despite market volatility, often referred to as paper hands. Unlike paper hands, which indicate a tendency to sell based on short-term price movements, those with diamond hands endure wild price swings, clinging to their investments for dear life. This unwavering conviction can lead to significant gains, especially when the price fluctuates dramatically.

Investors often find themselves in a dilemma: do they have diamond hands or paper hands? The slang term hands captures this essence, contrasting the resilience of diamond hands against the fragility of paper hands. Those who believe in the long-term potential of virtual currency typically embrace a strategy of holding onto assets despite market turbulence, adopting diamond hands as their mantra. By resisting the urge to sell during downturns, they position themselves for better outcomes in the future.

How to Develop Diamond Hands

To develop diamond hands in crypto, it’s essential to understand the difference between paper hands and diamond hands. The term diamond hands refers to investors who hold onto their cryptocurrency assets, even if the price fluctuates. In contrast, paper hands describes investors who sell their assets quickly, often due to fear or short-term trading pressures.

Fostering diamond hands is about recognizing the long-term potential and value of your investments. Those with diamond hands are less likely to be swayed by market volatility, which can lead to missed opportunities for significant gains.

Paper Hands vs. Diamond

In the crypto space, paper hands and diamond hands represent two distinct investment mindsets. Paper hands refer to investors who sell their assets quickly in response to market volatility, often driven by fear or uncertainty. In contrast, diamond hands describe those who hold onto their investments despite price fluctuations, demonstrating strong conviction in their assets. While paper-handed investors may exit positions early and potentially miss out on long-term gains, diamond-handed investors are often praised for their resilience, especially during market downturns. Ultimately, paper hands prioritize minimizing losses, whereas diamond hands focus on long-term growth and confidence in their investments.