A solo miner has successfully mined block #920,440 on the Bitcoin network, earning a reward of 3.141 BTC ($347,455), according to infrastructure company Umbrel.

MASSIVE congrats to another legend who beat the odds and solo-mined a block with @Public_Pool_BTC on their Umbrel and took home 3.141 BTC.

No middlemen. No third-parties.

Just pure self-sovereignty in action. pic.twitter.com/XbKTTDPyxa

— Umbrel ☂️ (@umbrel) October 23, 2025

According to mempool.space, the block contained 2,181 transactions, earning the miner an additional 0.016 BTC ($1,787) in fees. The operation was conducted via an Umbrel server connected to a Public Pool device. No further details on the equipment and hash rate are available.

On September 7, a solo miner mined block #913,593 on the Bitcoin blockchain, earning 3.13 BTC ($347,980).

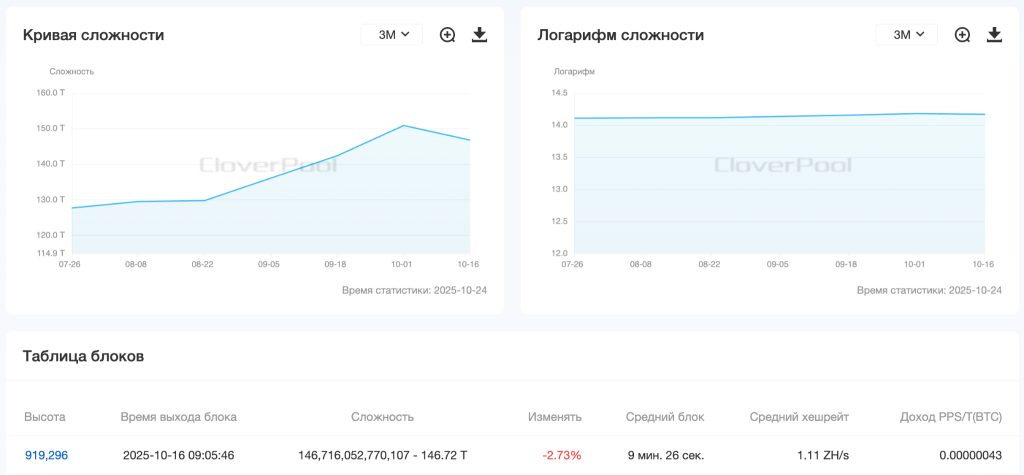

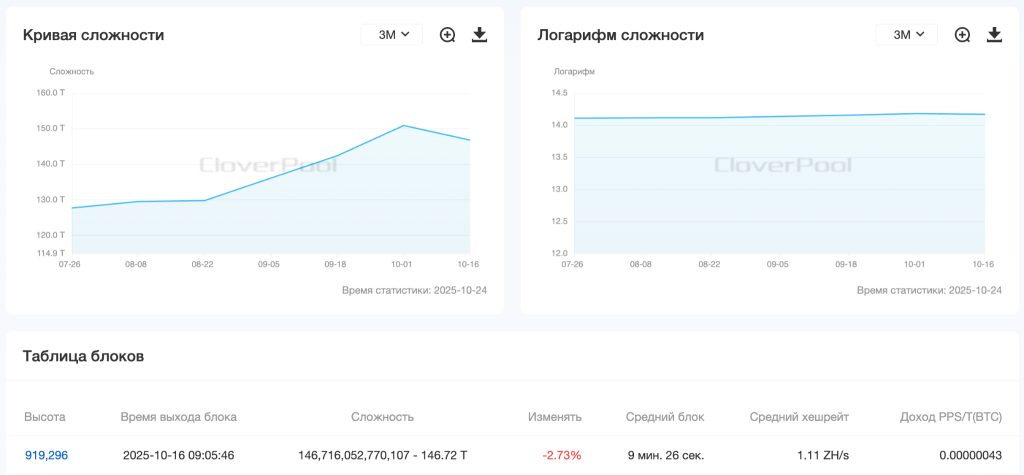

Previously, the difficulty of mining digital gold reached a record 150.8 T. Following a recalculation on October 16, the figure adjusted to 146.72 T. The current forecast for the metric predicts a 6.8% increase to 156.79 T.

Miners’ Stocks Decouple from Bitcoin

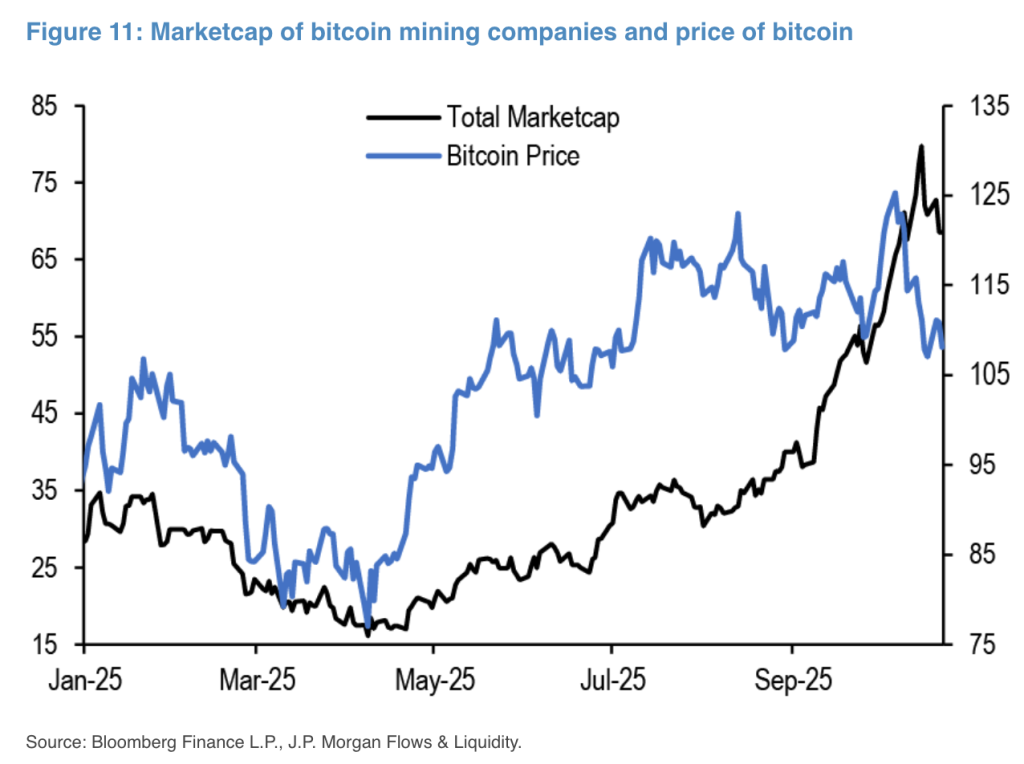

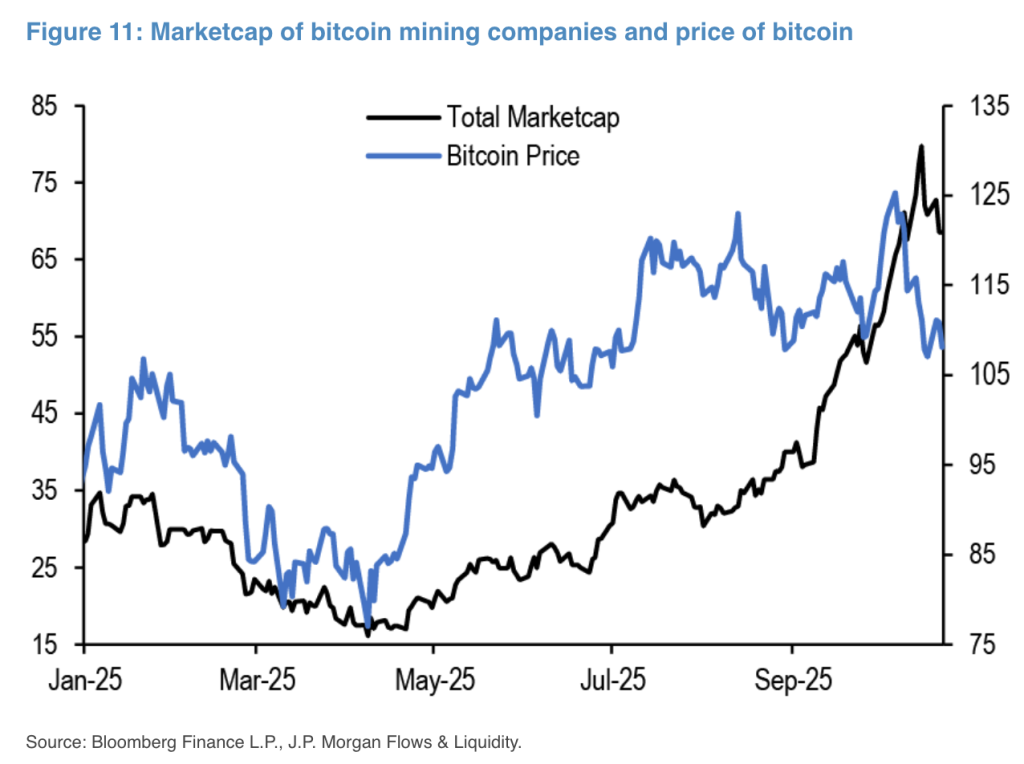

Analysts at JPMorgan have noted a disappearance of the correlation between the stocks of public mining companies and the price of Bitcoin, reports The Block.

Since July, the capitalization of these firms has risen despite Bitcoin’s sideways movement. Experts suggest this indicates a business revaluation due to a shift towards artificial intelligence.

Previously, miners’ stocks followed the price of digital gold. Before the advent of spot ETFs, they were often seen as a means to gain exposure to the asset.

Due to the reorientation of mining companies towards AI, stock markets have begun to reassess them based on the technology’s potential, JPMorgan suggested.

The shift to another sector is linked to declining profitability following the halving in April 2024. Analysts estimate the current average cost of mining one Bitcoin at $92,000, predicting an increase to $180,000 by the next block reward reduction in 2028.

At the time of writing, the leading cryptocurrency is trading around $111,400.

Experts believe that rising costs for energy and equipment, as well as the renewal of energy contracts, will keep production expenses high.

Additionally, a slowdown in network hash rate is expected amid a resource shift to AI computations. This trend favors large miners capable of engaging in both sectors.

Smaller companies are exploring alternative sources, including the creation of crypto treasuries, specialists concluded.

In September, the profitability of mining the leading cryptocurrency dropped by more than 7%.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!