Stripe has agreed to acquire crypto wallet provider Privy, marking its second significant crypto infrastructure deal in 2025 after its $1.1 billion purchase of stablecoin platform Bridge. The acquisition underscores Stripe’s ambition to unify fiat and crypto payments under a single programmable financial ecosystem. This will expand its toolkit for developers who want to build seamless Web3 applications.

Privy’s technology will plug directly into Stripe’s recently launched stablecoin-based accounts. This will create a cohesive framework for crypto-native payments, onboarding, and custody.

The company’s move signals a shift from Stripe as a payment processor to a fully integrated financial platform capable of facilitating large-scale cross-border crypto transactions. The exact details of the deal remained under wraps.

Stripe CEO Patrick Collison described the acquisition as part of a broader strategy to build “Internet-native financial services”. He proposes that this will align the firm more closely with stablecoins, embedded finance, and automated money movement across fiat and crypto rails.

Privy Deal Completes Stripe’s Crypto Infrastructure Stack

Founded in 2021, New York-based Privy offers wallet abstraction APIs that let developers embed non-custodial wallets directly into applications. This move removes the need for users to install browser extensions or external wallets. Privy powers wallet creation for platforms like OpenSea and Blackbird, generating wallets silently to streamline onboarding and keep users on the platform.

Privy raised over $40 million from investors. These included Ribbit Capital and Coinbase Ventures. Moreover, PitchBook valued it at $230 million in March. Stripe’s acquisition of Privy comes just months after its $1.1 billion purchase of Bridge, a stablecoin orchestration firm. Together, these deals consolidate wallet creation and stablecoin transaction rails under Stripe’s control.

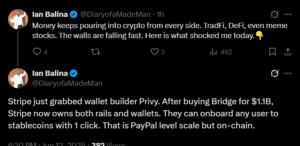

The integration would allow Stripe to onboard users directly into stablecoin systems without forcing a pivot to third-party crypto tools. Ian Balina, CEO of Token Metrics, noted in an X post that Stripe now owns “both rails and wallets,” allowing any user to access stablecoins “with one click.” The underlying implication is a vertically integrated model akin to what PayPal offers in fiat—but executed entirely on-chain.

Stripe would likely aim to solve crypto’s longest-standing UX problems: wallet onboarding friction. Privy’s ability to abstract away key management while maintaining user ownership aligns with regulatory pressures and developer needs.

Furthermore, Stripe’s infrastructure now spans wallet generation, programmable stablecoin flows, and global fiat compatibility. This positions the firm to serve both Web2 platforms exploring crypto rails and Web3-native projects targeting a broader audience.

Move Aligns With a Broader Institutional Drift Toward Crypto

Stripe’s acquisition of Privy may appear aggressive. However, it follows an increasingly normalized trend among public and private firms allocating capital to crypto infrastructure or digital assets. While Stripe builds in-house architecture through targeted acquisitions, other companies have opted for balance sheet exposure and ecosystem partnerships to establish a foothold.

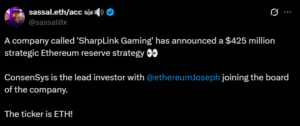

Gamestop shared plans for a $500 million Bitcoin purchase spree. SharpLink, a digital sports gaming firm, disclosed an Ethereum allocation earlier this year. The move is framed as part of a broader treasury diversification strategy. Oblong Inc. added Bittensor’s TAO token to its corporate holdings recently, citing interest in decentralized AI networks. These aren’t isolated events—they reflect a shift in capital planning frameworks, particularly in small to mid-cap tech firms seeking asymmetric upside.

The pivot also mirrors post-2023 structural changes in corporate finance. With interest in traditional treasuries waning amid inflation volatility and rate recalibrations, digital assets have entered the conversation as programmable, globally liquid reserves. Firms increasingly view tokens not as speculative instruments but as network-native assets with embedded utility or exposure to broader tech narratives.

Stripe’s differentiated edge is control. By acquiring Bridge and Privy, it now manages the wallet layer and the stablecoin rails. But in a broader context, it joins a cohort of institutions rethinking their financial stack—some by rewriting code, others by reallocating capital. The convergence is apparent: corporate finance is absorbing crypto, slowly but deliberately.