Credit: https://creativecommons.org/licenses/by-sa/3.0/deed.en

Even as the HPC-AI sector cheers on more powerful chips, denser servers, faster fabrics, bigger memory and mammoth, multi-hundreds of billion-dollar AI data centers, a voice is whispering in the industry’s ear: “Where’s the electricity for all this?”

Good point! It’s generally assumed the data center energy gap will be filled by some combination of more efficient systems and more ways of generating greater power. Along with fossil fuels, the focus is on new, preferably clean, energy sources, a mix of solar, wind, hydrogen and, maybe someday, fusion.

Regarding nuclear power, Deloitte Insights has released a report, with mixed conclusions.

The good news – good, that is, if you’re not fundamentally opposed to nuclear energy – is that it’s undergoing a revival and it’s virtually carbon-free. On the other hand, it will at best only partially close the energy gap.

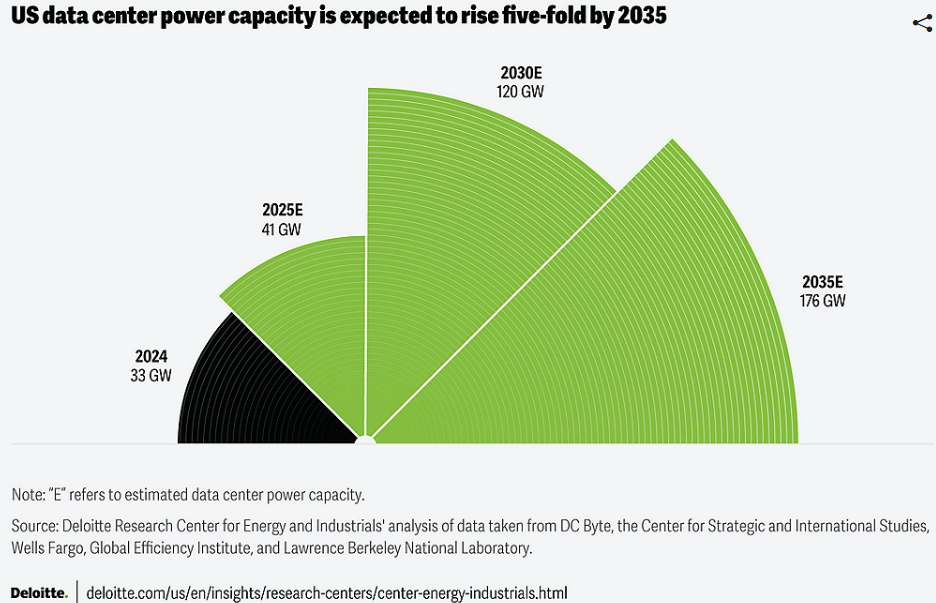

According to Deloitte’s report, data center electricity demand could rise five-fold by 2035, to 176 GW, and the firm said nuclear power capacity “could potentially meet about 10 percent of the projected increase in data center power demand over the next decade. This estimate is based on a significant expansion of nuclear capacity, ranging between 35 gigawatts and 62 GW during the same period.”

Currently, nuclear energy powers nearly 20 percent of U.S. electricity despite representing less than 8 percent of the nation’s total operating capacity. However, the country’s nuclear resource is aging: the U.S. has 94 operating reactors with an average age of 42 years.

Deloitte Insights reported that more than 80 percent of these reactors have been relicensed to operate for up to 60 years or even 80 years with a subsequent license renewal. Upgrades and modernization of these reactors could raise capacity. Deloitte cited sources reporting that “The cumulative uprates from 1977 to 2021 amount to 8,030 MW, averaging about 0.18 GW per year over 44 years.”

In addition, reviving closed plants, as Microsoft intends to do with the old Three Mile Island plant in Pennsylvania, is another option that is less expensive than building new plants of similar capacity, Deloitte said.

Other projects call for building new reactors at existing nuclear and coal-fired power sites, “taking advantage of existing infrastructure and streamlined licensing processes.”

Another approach is small modular reactors (SMRs). These factory-built reactors offer potential advances over traditional nuclear reactors, Deloitte said, including “black start capability, islanding, underground construction, fuel security, and continuous operation, making them highly resilient and suitable for infrastructure like data centers.”

Regarding next-generation reactor designs Deloitte said they have the potential to “enhance safety, efficiency, and fuel utilization, and microreactors offer unique advantages for remote locations, off-grid applications, and specialized energy needs, making them viable options for powering data centers.”

In addition, SMRs “drastically reduce construction timelines” and can enhance safety, incorporating “passive safety systems (gravity, natural circulation), potentially reducing the need for operator intervention. The smaller core and lower power density further minimize risks. Some designs even incorporate underground construction for added protection.”

However, nuclear power remains a controversial energy source. As Deloitte stated, “public opinion on nuclear power in the United States is complex and evolving, and so the path to scaling it for data center demand is not without challenges.”

In addition, nuclear plants typically face lengthy regulatory approval cycles and “often face challenges related to construction timelines and cost overruns, which can hinder their economic viability and competitiveness with other energy sources,” Deloitte reported, citing a commercialized project that went over budget by more than 114 percent and was delayed six years.

Nuclear power plant construction is costly. Deloitte cited a source reporting that “In 2024, the capital expenditure to develop nuclear facilities ranged from US$6,417 to US$12,681 per kilowatt (kW), while that of natural gas facilities was about US$1,290 per kW.”

On the upside, nuclear offers reliable baseload power, operating 24/7 regardless of weather conditions, unlike wind and solar. Nuclear also has a higher capacity factory than natural gas, 92.5 percent vs. 56 percent.

And nuclear is scalable. Deloitte’s report stated that “a single nuclear reactor typically generates 800 megawatts (MW) or more of electricity, readily meeting the power demands of even the largest data centers (50 MW to 100 MW) and the burgeoning requirements of AI-focused facilities (up to 5,000 MW).”

In all, nuclear offers promise, perils and a partial solution for the energy gap.

The full report can be found here.